West Java, Indonesia — A growing number of regional financial institutions in Indonesia are drawing attention from observers abroad, and one of the latest examples is PT BPR Cirebon Jabar Perseroda. The bank, jointly owned by the Cirebon Regency Government and the West Java Provincial Government, has reported a steady rise in assets and improved governance standards, positioning it as a key player in the country’s community-based banking segment.

Originally formed through the merger of seven BPR offices that were later consolidated into BPR Astanajapura, the institution underwent a series of structural adjustments before adopting its current form as a Perseroda entity in 2022. The shift was aimed at aligning the bank with modern regulatory frameworks while improving operational oversight and financial transparency.

According to publicly available financial data, PT BPR Cirebon Jabar Perseroda has seen its total assets grow from approximately IDR 500 million in earlier decades to more than IDR 400 billion today. The expansion reflects a broader trend among Indonesian regional banks that are increasingly serving micro and small enterprises as part of the government’s economic inclusion strategy.

The bank offers a suite of basic financial services, including credit, savings, and deposit products, with a focus on rural and low-income communities. Analysts note that such institutions play a critical role in regions where commercial banks remain limited. PT BPR Cirebon Jabar Perseroda has also taken steps to counter informal lending practices by widening access to formal credit channels.

In recent years, the bank has been recognized by provincial authorities for its governance improvements. The West Java Provincial Government, together with the national audit body BPKP, cited PT BPR Cirebon Jabar Perseroda for meeting key Good Corporate Governance criteria, emphasizing its financial health and commitment to regulatory compliance. Governance transparency has become an increasingly important benchmark for Indonesian regional enterprises seeking public trust.

In 2025, PT BPR Cirebon Jabar Perseroda attained an EXCELLENT rating in the Financial Integrity Rating on Money Laundering and Terrorism Financing (FIR on ML/TF). The assessment evaluates the integrity and effectiveness of APU, PPT, and PPPSPM reporting among Financial Service Providers and Goods and Services Providers. This accomplishment affirms the institution’s strong commitment to supporting PPATK and law enforcement efforts in preventing money laundering, terrorism financing, and proliferation financing, as well as its outstanding level of compliance and reporting quality.

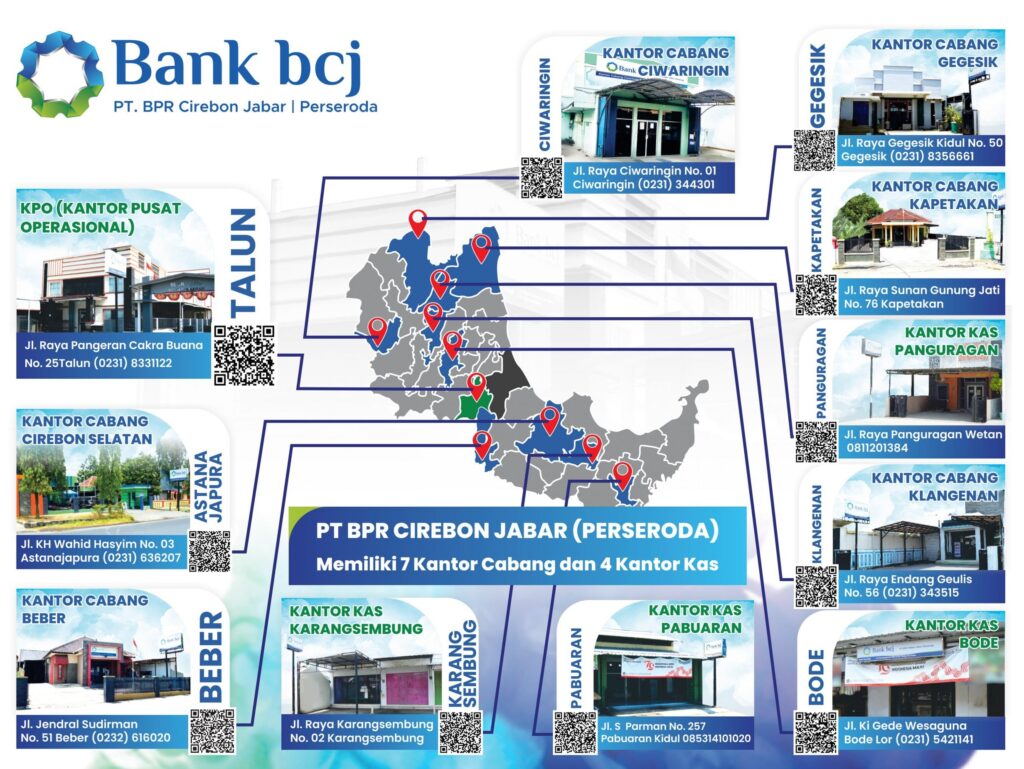

The bank’s strategic direction centers on supporting local economic growth through accessible financial services. Its mission includes expanding business opportunities in rural areas, strengthening MSMEs, and promoting financial literacy. PT BPR Cirebon Jabar Perseroda operates from its headquarters in Talun, Cirebon, with additional branches and service units that extend its reach across the region.

Observers suggest that as Indonesia pushes for deeper financial inclusion and improved regional governance, institutions like PT BPR Cirebon Jabar Perseroda will play a vital role in stabilizing local economies. With digital transformation accelerating in the banking sector, the institution is expected to adapt by enhancing service delivery and strengthening internal systems.

From an international standpoint, the bank’s trajectory illustrates Indonesia’s broader effort to modernize rural financial infrastructure while maintaining a strong community-centered mandate.