United States – President Donald Trump is facing resistance from within his own party as he intensifies pressure to pass a sweeping budget bill that aims to reshape tax policy and entitlement spending. The outcome of the bill, which features an estimated $4.9 trillion in tax cuts, could have long-term economic implications both domestically and globally.

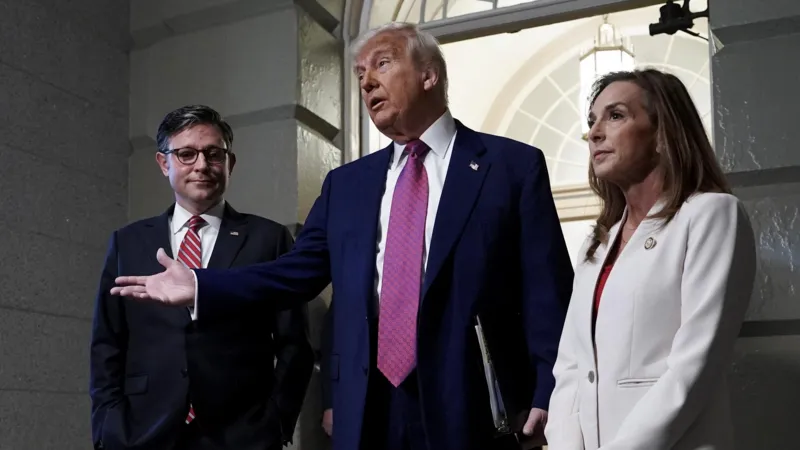

On Tuesday, Trump made a rare visit to Capitol Hill, engaging directly with House Republicans in an effort to bridge party divisions. The legislation—heralded by Trump as a “big, beautiful” plan—is viewed as a cornerstone of his fiscal agenda and a test of his leadership in his second term.

The proposed bill includes provisions that triple the cap on state and local tax (SALT) deductions from $10,000 to $30,000 for married couples. While designed to appeal to taxpayers in high-cost states, it has drawn criticism from Republicans representing New York, California, and New Jersey, who argue the change remains inadequate for middle-class constituents.

Representative Mike Lawler, a New York Republican, stated his opposition bluntly: “While I respect the president, I’m not budging on it.” Other lawmakers from similar districts echoed his concerns, creating a potential bloc of dissenters that could derail the bill in the House.

Healthcare reforms are another critical flashpoint. The legislation proposes new work requirements for Medicaid eligibility, set to take effect in 2029. These include mandatory 80-hour monthly work or community engagement conditions for able-bodied beneficiaries. While intended to reduce long-term government spending, the proposal has sparked debate over its ethical and economic impact.

Some conservative lawmakers argue the bill does not go far enough in cutting Medicaid spending. On the other end of the spectrum, moderates fear the move could harm vulnerable populations, especially in economically struggling areas.

Despite the challenges, the bill narrowly passed the budget committee with a 17–16 vote over the weekend. Trump is now focusing on securing enough Republican votes in the House, where the party holds a narrow majority. A full vote is expected by midweek.

The stakes extend beyond domestic politics. Economists are watching closely to assess the bill’s potential impact on inflation, consumer spending, and state-level budgetary balances. The tax breaks and entitlement reforms could shift fiscal dynamics across sectors and alter the trajectory of U.S. economic growth.

Moreover, global investors are paying attention to the political maneuvering in Washington. Confidence in U.S. fiscal policy—and its ability to pass complex legislation—plays a role in shaping global markets, from currency strength to capital flow expectations.

As President Trump continues lobbying House members, the fate of the bill remains uncertain. But its success or failure may become a bellwether for his ability to deliver major policy shifts during his second term, with consequences reaching far beyond American borders.